How to Track Business Expenses Like a Pro

How Electric Vehicles Are Impacting the Highway Trust Fund and What That Means for Your Financial Future

Navigating the 2025 IRS Tax Bracket Adjustments and What They Mean for You

State Corporate Income Tax Rates 2025

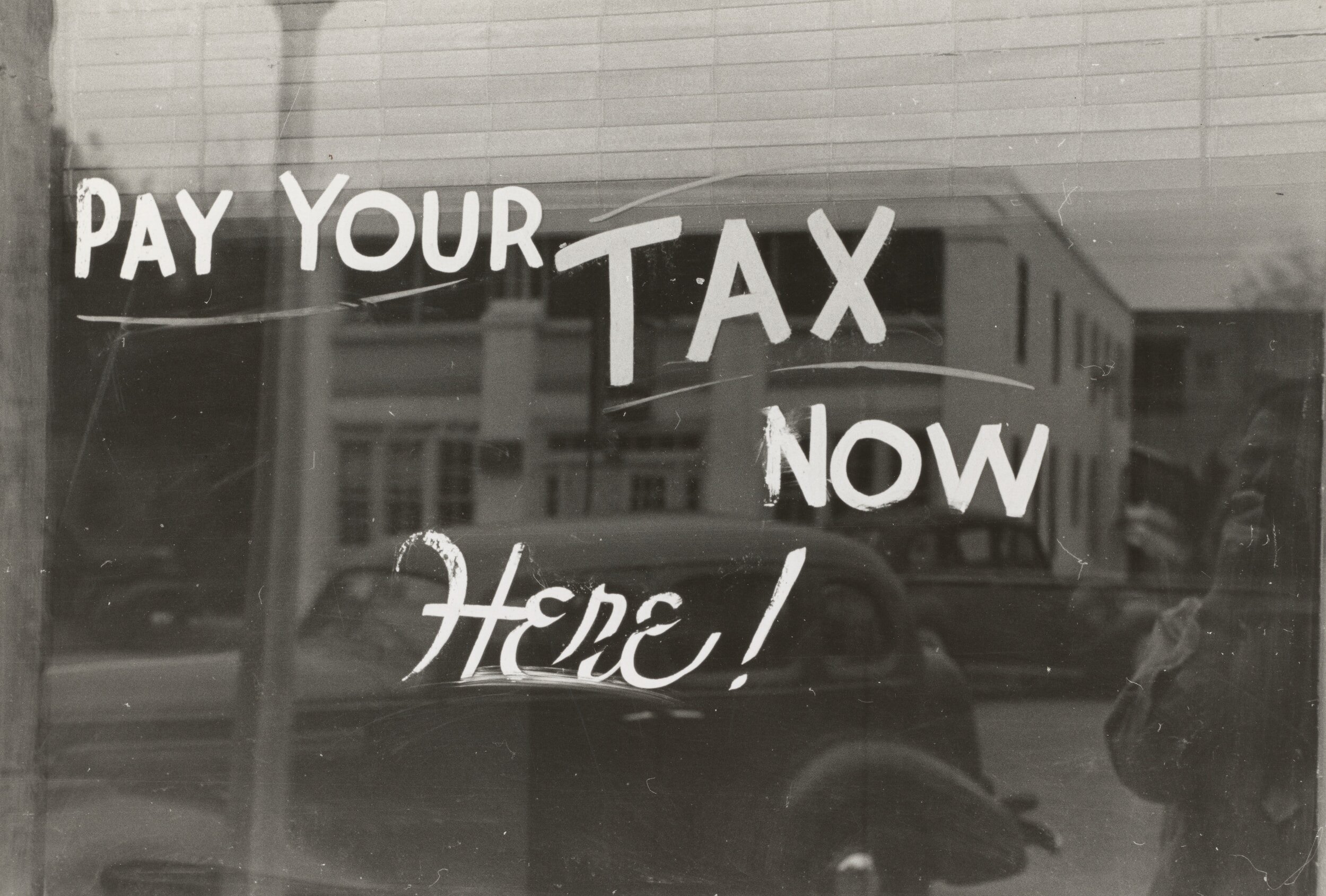

What You Need to Know to Get Ready for Tax Season 2025

Decoding the Federal Reserve's Recent Rate Cut. The Direct Impacts on Your Finances

How I Learned To Budget the Unexpected After the Car Caught On Fire

Life is full of uncertainties, and unexpected emergencies can happen when we least expect them, like when my neighbors car caught on fire a few years ago after making strange noises for a little too long. He thought it was just a quick fix and kept pushing going into the shop to get it fixed. It cost him more than he had anticipated to fix and after this he came to me and asking for help to set up a budget that would allow him to be prepared for these sorts of incidents, at least money wise.

Cloud-Based Accounting, What Is It?

Technology continues to revolutionize the way businesses handle their accounting processes and one notable advancement that has gained immense traction is cloud-based accounting. In this blog post, we'll explore the essence of cloud accounting, its transformative impact on traditional financial practices, and the myriad benefits it brings to businesses of all sizes.

A Comprehensive Guide on How Businesses Can Prepare for Tax Season

In light of the approaching annual tax responsibilities, taking early action can turn the process from an overwhelming duty into a chance for financial empowerment. Your business will not only meet its tax responsibilities on time but also lay the groundwork for future financial success if you plan ahead and allow yourself the opportunity to be prepared. In this comprehensive guide, we explore the essential steps that can empower your business to prepare effectively for tax season.

Choosing the Right Path for Retirement: Understanding Regular 401(k) vs. Roth 401(k)

Selecting the appropriate retirement savings plan is a pivotal decision in financial planning. The Regular 401(k) and Roth 401(k) are two prevalent choices, each with unique benefits. This post aims to elucidate the differences and assist in determining the most suitable option for your retirement goals.

A Guide to Early Preparation for your Tax Season

As the saying goes, "It's never too early to prepare," and when it comes to tax season, truer words have never been spoken. While the deadline may seem distant, laying the groundwork for a smooth and stress-free tax season is a strategic move that can save you time and headaches down the road. In this blog, we'll delve into the importance of early preparations and offer some actionable tips to ensure you're well-prepared when tax season arrives. . . . . . Need help with your business? 4Wealth is the place for you!

Building a Secure Financial Future!

Planning for the future, especially for retirement, is a cornerstone of sound financial management. One of the most powerful tools available for this purpose is the 401(k) retirement savings plan. In this blog, we will delve into the importance of a 401(k) and why it plays a pivotal role in securing your financial future.

IRS 1099 Essentials For Business Owners

As a business owner, staying on top of your tax responsibilities is important for financial health and compliance. One key aspect of tax reporting is the issuance of IRS Form 1099, which has undergone some changes in recent years. Here are the essentials of IRS 1099 for business owners, with a focus on Form 1099-NEC and the nuances introduced in 2022.

A Guide to Successfully Rebranding

Your brand is more than just a logo, name, or visual identity. It’s your company’s heart and soul. It encompasses the entire perception of a company, product, or service in the minds of the consumer.

How to Build Generational Wealth

You may have heard the terms “generational wealth” or “family wealth” and thought, “that sounds like something I should start doing”. But with financial obligations like paying off debt, saving money, and achieving other financial goals, the thought of generational wealth may have gotten lost in the mix.

The Power of a Team: Why Teamwork Matters and How to Build It

In a team, each member is responsible for contributing to the group's success, and success is achieved through the collective effort of all members.